Nagarro

We can all remember a recent headline of a major automaker recalling a specific car model due to safety or regulatory concerns. It seems to be happening more often, but car recalls are nothing new. In fact, they began in the early 1900s, approximately 100 years ago. While they are not new, the unprecedented flow of information has substantially increased their impact in today's society. Recalls impact a company's top and bottom line and lead to a loss in brand equity. News of auto giants like Volkswagen, General Motors, and Audi trying to control the damage they create has become commonplace.

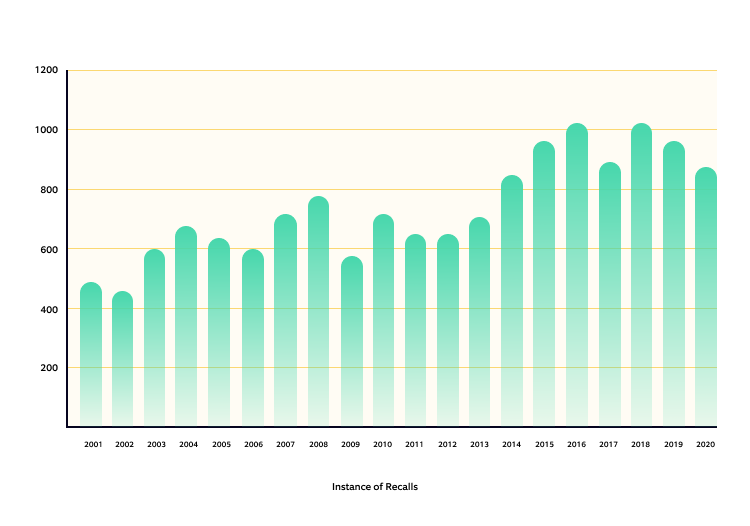

Figure 1: NHTSA data on recalls (in USA)

Figure 1 shows the number of recalls undertaken in the US market. The problem has only intensified, as automotive recalls have only increased over the years. This article highlights the underlying challenges of original equipment manufacturers (OEMs) in avoiding and handling these recalls. We will also look at how AI, ML, IoT-based interventions can solve these challenges and mitigate any recall-related damages.

How do recalls impact OEMs?

Recalls affect OEMs in multiple ways. Here are a few examples:

- Additional cost burden: OEMs' cost burden to resolve a recall is humongous. For example, the Takata airbag recall affected 67 million airbags from more than 42 million vehicles, manufactured by more than 20 OEMs. It had huge cost implications on both Takata and the OEMs. In 2017, Takata had to file for bankruptcy while OEMs had to bear billions of dollars of cost for handling the recall.

- Irreversible damage to customer loyalty and satisfaction: The 2016 Customer Satisfaction Index reveals that customer satisfaction with recall service stands at 781 on a 1,000-point scale (down from 789 in 2015). On the other hand, satisfaction among customers with non-recall servicing averages 809 in 2016.

- Loss in brand value: Toyota's faulty gas pedal, which led to unintended acceleration and may have been involved in 89 deaths and 52 injuries, led to a stream of recalls in 2010. The recalls plunged Toyota's stock prices by more than 20%, equivalent to $35 billion.

- Lawsuit & fines: Recalls invariably bring about legal actions by customers and regulators to penalize the OEMs. In 2014, Toyota was fined $1.2 Billion for misleading U.S. consumers. They were found to have concealed information and made deceptive statements about two safety-related issues in their vehicles, each of which caused a type of unintended acceleration.

The underlying challenges

Recalls can broadly be classified into three categories:

a) voluntary recalls by OEMs

b) post-purchase customer complaints

c) mandated by regulatory agencies

Each type of recall has a different financial impact and brand image dilution for OEMs.

- Voluntary recalls are the least severe,

- A post-purchase customer complaint is second.

- Regulatory forced recalls are the most severe, with the largest negative financial and brand image impact.

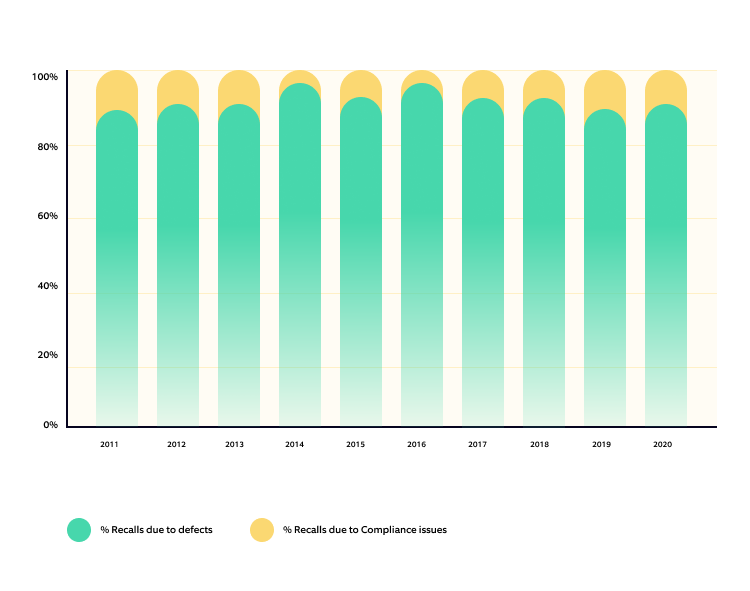

Figure 2: Percentage of recalls due to defect vs. compliance

Figure 2: Percentage of recalls due to defect vs. compliance

Recalls can be due to a defect in the parts or non-compliance with the safety and regulatory norms.

As per NHTSA data (figure 2), most of these recalls are due to vehicle parts defects, emphasizing that quality-related issues are still a key factor in major markets like the US.

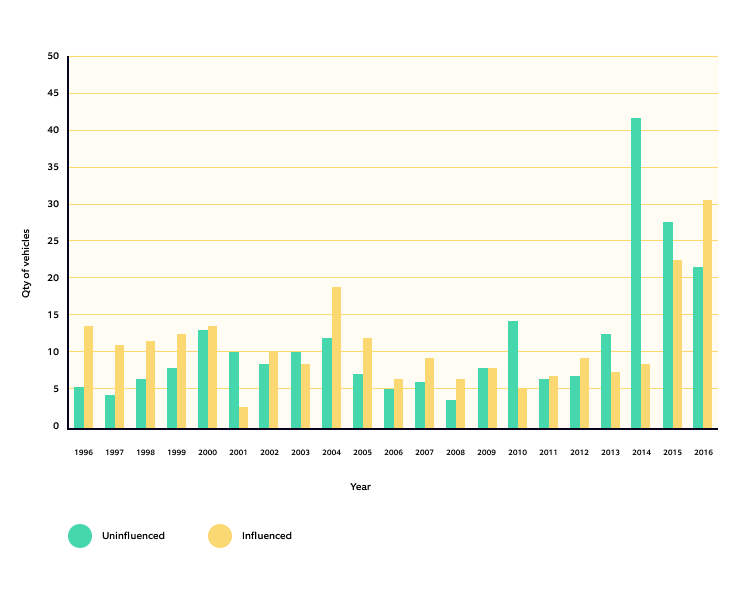

Figure 3: Quantity of vehicles recalled 1996 - 2016

Instead of being proactive, most car companies have been reactive when dealing with recalls. This can be seen from figure 3, which shows that vehicles recalled due to regulatory influence form a major part of all the recalled vehicles. But why?

Here are some of the underlying reasons for such an approach:

- Lack of monitoring: After the market launch, most OEMs don't monitor the performance of the components in the market. It is no wonder they can only react to any reported defects.

- Reduced developmental cycle and cost-cutting: Driven by the customers always seeking new features and products, OEMs try to reduce their developmental cycle and costs by implementing automation and reducing redundancy in testing. This adds the risk of missing out on some failure modes and manufacturing variations, leading to potential defects. Cost-cutting measures such as changing material sources and grade or process modification can also lead to reduced or inferior quality. Moreover, tier 1 and tier 2 vendors are constantly under pressure to reduce the costs of the components, cut prices and price matching offered by lower-cost suppliers.

- Lack of traceability of components: Once a failure is discovered in the market, it is critical to know how many vehicles are affected. Traditionally, an OEM would have to recall all the vehicles produced in the same batch as there is no method to track if only some vehicles produced in that batch are malfunctioning.

- Complexity and high time requirement: Once a faulty vehicle component is detected, any countermeasure to solve the issue can only happen after the root cause is known. Root cause analysis, countermeasure development, and deployment is a complex process. Contrary to the wishes of OEMs, it requires time to fix things as soon as possible.

Taking a U-turn: An OEM's recall journey

Once a car is detected with a faulty component, the auto company goes into firefighting mode and eradicates the problem ASAP. The standard product development cycle is around 2-4 years. Each component is designed, modified, and tested in multiple stages to ensure that any car component doesn't fail. Once a component fails in the market, this work must now happen within days or weeks.

Let's look at the phases in the journey (described in detail in diagram 1 and table 1) from the OEM's perspective, right from the point when a customer complaint or feedback is provided:

.png?width=750&name=Illustration%204%20(2).png) Diagram 1

Diagram 1

- Trigger: A customer complaint is a trigger for the service function. Service will direct it to the market quality assurance department on the field to check the problem and establish the root cause. If the specification of the part is not as per requirement, the vendor (who supplied the part) will change it as per the warranty terms and the supply chain will help resolve it. However, if the specification is in line with the requirement, the quality team will coordinate with the R&D team to ascertain the root cause. The R&D team will then bring the vehicle to the lab for further analysis and root cause analysis. But what if a customer cannot detect an underlying problem and doesn't file a complaint? In that case, it can lead to potential accidents or a bigger problem that affects the functionality of other car components.

- Assessment: OEM assesses the feedback/complaint of the customer to figure out if it is unique to a particular vehicle or a non-unique phenomenon. Anything unique to a specific vehicle means that it could be just one odd case. If there is no underlying issue in the components, the issue can be resolved by repairing or replacing the affected parts. If the problem is non-unique and prevalent in other vehicles, there is some underlying issue in the component and should be checked thoroughly.

- Repair vs. recall: If the issue is unique, simply repairing that vehicle will solve the problem. For a non-unique problem, all the affected vehicles must be recalled at the dealership for part repair or replacement. This is one of the most challenging and critical stages. If, the tracking of affected vehicles, is done properly, it can save huge costs for the OEMs by reducing the number of vehicles to be recalled. If the decision is of recall, then there could be two situations:

i) The reason is tracked and known: If the cause is easily tracked to some process or part defect (not as per specification), it can be corrected back to the required level, and the vendor supplying the part will change it as per the warranty terms.

ii) The reason is unknown: If the reason for the issue is unknown, the OEMs must simulate the failure in the lab to find out the root cause. Once the root cause is known, that part of the process or component must be modified. OEMs must evaluate the modified part before rolling it out into the market and fitting it into the vehicles of the same models running in the market. This entire cycle is complex and demands a lot of time and resources.

Time to change gears: Opportunities provided by technology

Can technology help automotive? Today, AI, IoT, etc., provide great opportunities to solve the current challenges of OEMs. With computation power becoming a commodity and a huge amount of data generated from hundreds of sensors in a modern automobile, such tools and technologies can provide great insights. Let's look at how technology can come to automotive's aid:

- Monitoring: A digital twin of a component can help remotely monitor the vehicle's performance in the market. A trained ML algorithm can easily highlight any anomaly in the performance and help in proactive problem resolution.

- MTTR reduction: A digital twin can speed up the process of failure simulation and root cause analysis, reducing the MTTR (mean time to resolve problems). It can help in simulating multiple failure modes without taking the actual vehicle on the test track and simulating the failure on the track or a test rig. It can also aid in modifying parts and new part evaluations before fitment into the vehicle, making it more accurate and less time-consuming. A digital twin can reduce the product evaluation and testing time by at least 40%.

- Tracking: A digital twin with the captured performance data of components can help accurately identify the affected vehicles that need to be recalled, thus saving billions of dollars of potential cost for the OEMs.

Let’s look at the entire recall journey for OEMs to understand their goals, expectations, pain points, and opportunities for technological interventions.

.png?width=750&name=Illustration%205%20(2).png) Table 1: OEM's recall journey

Table 1: OEM's recall journey

How a digital twin helps: An example

Digital twins can help in two ways:

- Through optimized product development, a product is launched with a higher specification and optimized based on data from the actual usage.

- They also track the vehicle's performance in the market.

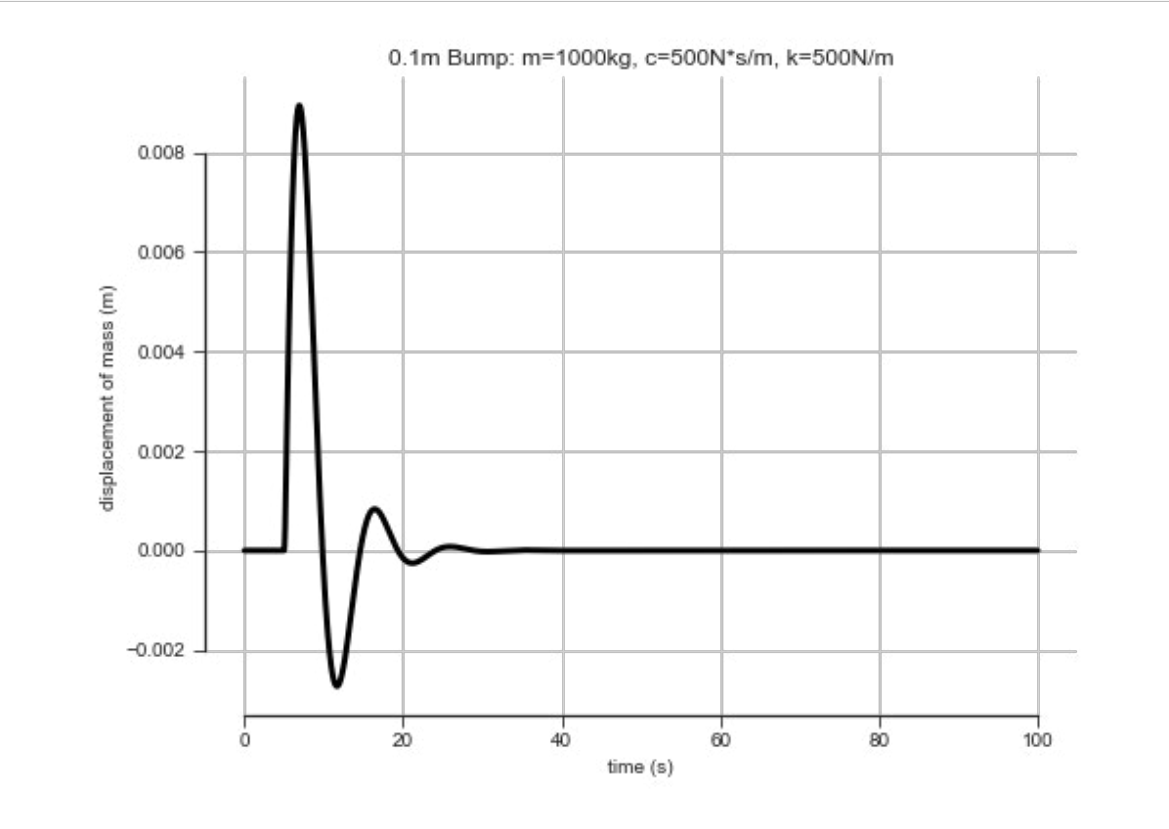

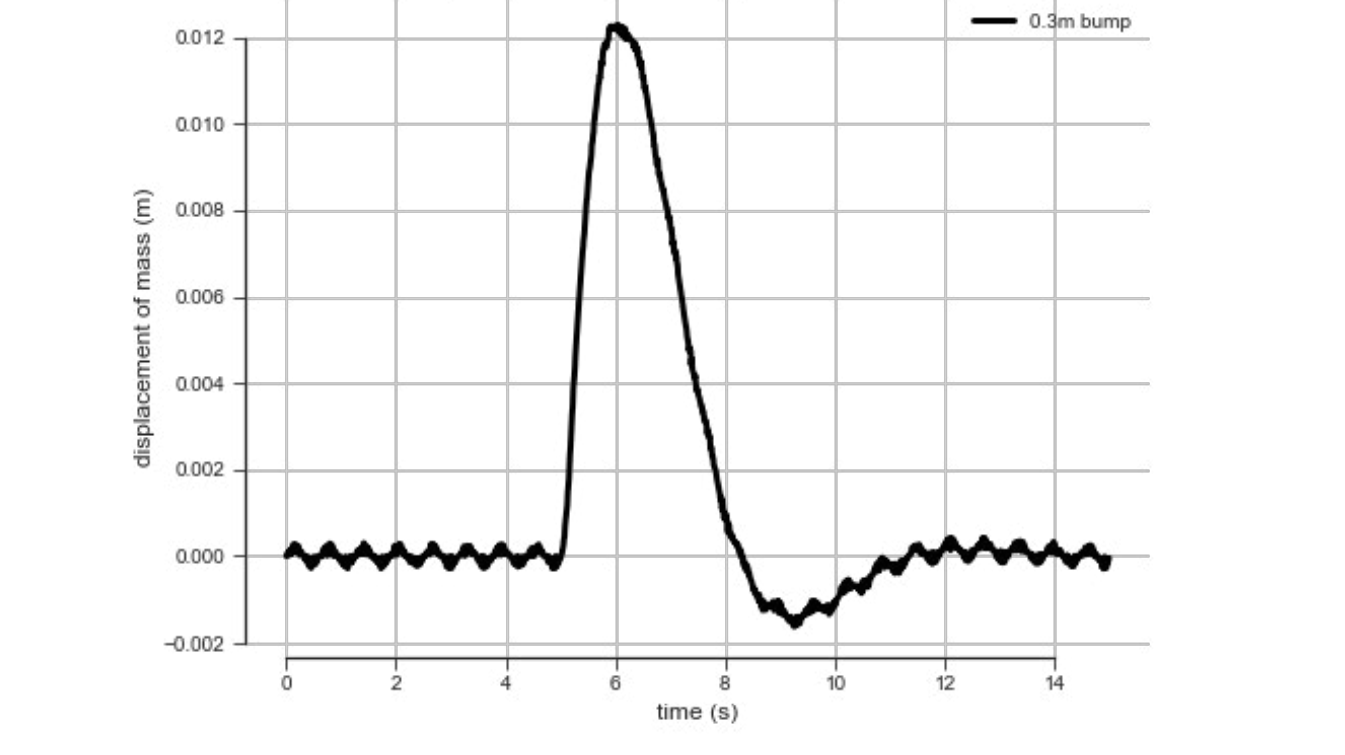

Let's take a simple example of the digital twin of a suspension and see how it can help resolve market complaints quickly. Assume a situation where a car goes over a bump. The car's suspension absorbs some bumps and passes on only a small amount of it. Figure 4 shows the movement of the car's body when it goes over a bump of 0.1 m. Similarly, taking the car over bumps of different heights will have different performance curves.

Figure: 4

Figure: 4

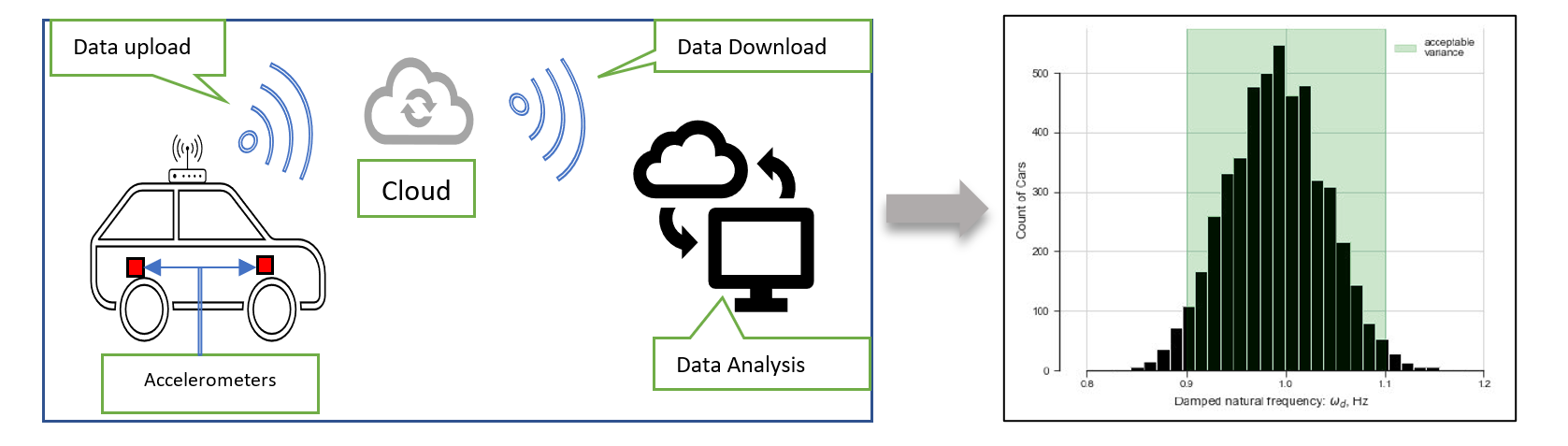

A car's suspension can be fitted with accelerometers that capture and transmit the acceleration values when the car goes over a bump. This acceleration data can be integrated to find the displacement. This car can then be sent over different profiles of bumps on a test track, or run in the market to capture the performance band of the suspension. Figure 5 explains how it would work.

A fleet of vehicles is run to consider the part-to-part variation caused by manufacturing. The entire performance data is analyzed and stored to create a performance band of the suspension, which looks like a normal distribution, as shown in figure 5.

Figure: 5

After the vehicle's launch, the data from the sensors is analyzed for any anomalies in the real world. If there is any anomaly beyond the normal working range, the part or manufacturing process can be modified to resolve it.

Any complaint can be analyzed using the suspension data for root cause analysis. Modifications can be done without waiting for the actual vehicle. An AI/ML model can be trained to predict and notify any potential issue to the OEM. For instance, a trained ML algorithm can analyze the data observed in figure 6, it can easily infer that it's due to bush wear.

Figure: 6

Figure: 6

Conclusion

Technology holds the key to making companies agile and proactive about preventive maintenance and handling recalls. It will also reduce the testing time (reduced time-to-market) and provide inputs from the market on developing a new model (R&D). Creating such a tech infrastructure would require initial investments in terms of time and resources. OEMs can benefit through excellent returns from customer confidence, brand equity, and customer loyalty in the long run. Such technical capabilities can also reduce the costs associated with new product development, assembly, and, importantly, post-launch issue resolution.

To know more about our digital capabilities in the automotive domain, explore our offerings and get in touch with us.

References: