Manu Lakhanpal

A few months ago, I switched banks to embrace a more user-friendly digital banking experience, particularly drawn to their modern Customer Identity and Access Management (CIAM) solution. As someone who values convenience and security, I was particularly impressed from the moment I began the onboarding process. The bank's CIAM system facilitated a swift and secure account creation process using my email and phone number. I appreciated the two-factor authentication that added an extra layer of security without unnecessary complexity. Unlike my previous banking experience, that required me to juggle multiple passwords and security questions, this system used secure biometric authentication for effortless log in.

Post-onboarding, I experienced the benefits of personalized services. The app greeted me by name and proactively offered financial advice tailored to my spending patterns. For instance, it suggested budgeting tools that aligned with my financial goals, simplifying my financial management.

Furthermore, the CIAM system streamlined customer support. When I needed assistance, accessing help through the app was easy. The system recognized my identity, enabling support representatives to quickly retrieve my information, saving me valuable time and making me feel valued as a customer.

Overall, this modern CIAM solution transformed my banking journey to a seamless banking experience. It not only provides enhanced security but also delivered personalized and efficient service, making financial management a breeze. This positive experience solidified my belief in implementing robust CIAM solutions in the Banking, Financial Services, and Insurance (BFSI) sector.

As the (BFSI) sector embraces digital transformation, robust CIAM solutions are vital. These solutions are designed to securely manage customer identities and access across various platforms. They play a crucial role in ensuring that organizations provide seamless and secure access to their services while safeguarding sensitive customer data and facilitating personalized customer experiences.

As the adage goes “It’s rightly said that we cannot understand the value of something good unless we truly recognize the difference & impact of what we right now hold on to.”

This blog explores the critical role of Customer Identity and Access Management (CIAM) solutions in future-proofing the Banking, Financial Services, and Insurance (BFSI) sector. It delves into the shortcomings of legacy systems, highlighting the need for modern, agile solutions.

The Shortcomings of Legacy and Custom-Built Identity Systems

Many BFSI organizations rely on custom-built identity systems or disparate legacy infrastructures. While these solutions address short-term needs, they fail to scale, adapt, or deliver seamless experiences to today’s customers and regulatory landscape demand in the BFSI industry.

Key challenges

For end users:

- Fragmented User Experiences: Customers often need to log into separate services (e.g., retail banking, insurance, credit), that leads to reduced engagement.

- Data Security and Trust Concerns: Weak authentication systems expose users to data breaches, phishing, and account takeovers. Reports highlight that financial institutions face increasing threats such as ransomware, costing an average of $2.58M per attack in 2024 (Venio IT Analysis).

- Slow Onboarding: Manual document verification and lengthy forms deter customers, with 50% abandoning the onboarding process due to poor user experiences (source: ForgeRock).

For BFSI Institutions:

- Fragmented Identity Systems: Silos across legacy systems hinder data consolidation, personalization, and efficiency, delaying onboarding processes and impeding service delivery.

- Regulatory Compliance Hurdles: Meeting dynamic regulations like GDPR, CCPA, PSD2, and AML requires costly updates to custom-built systems. In 2022 alone, GDPR fines exceeded $1 billion.

- Limited Fraud Protection: Traditional systems fail to detect advanced threats like credential stuffing and bot attacks, with 75% of financial institutions reporting at least one account takeover attack per year (Abnormal Security).

- High Costs and Scalability Issues: Legacy systems demand significant investments for upgrades and lack the agility to support growing user base.

Why CIAM is a Game-Changer for BFSI

CIAM goes beyond basic identity, authentication, and authorization. Modern solutions are pivotal for transforming customer interactions, enhancing trust, and maintaining competitive advantage.

Leveraging Michael Porter’s Five Forces Model

Porter’s framework offers a strategic lens to understand CIAM’s transformative potential within the BFSI sector:

1. Threat of New Entrants

The BFSI sector is witnessing intense competition from agile fintech startups and neobanks. These disruptors prioritize customer-centricity favoring features like seamless onboarding, robust security, and superior user experiences.

How CIAM Mitigates This Threat:

- Frictionless Onboarding: Features such as password-less authentication and adaptive risk models reduce onboarding time by up to 70%, as seen in ForgeRock’s implementation for legacy banks.

- Regulatory Compliance: CIAM providers ensure BFSI institutions meet global standards like GDPR and PSD2 with pre-built compliance modules.

- Fraud Detection: AI-driven tools like behavioral analytics counteract advanced fraud techniques.

Case Study: A neobank adopting single sign-on (SSO)-enabled CIAM gained substantial market share by offering superior onboarding experience (Okta).

2. Bargaining Power of Customers

Today’s customers demand seamless, secure, and personalized experiences. If their needs are unmet, they can easily switch to competitors. How CIAM Enhances Customer Loyalty:

- Enhanced Customer Experience: SSO, multi-channel access, and personalized dashboards improve usability, reducing churn by up to 40% (Okta).

- Tailored Recommendations: Unified customer profiles enable BFSI institutions to deliver bespoke offers and services.

Example: ForgeRock helped a wealth management firm integrate client data across channels, boosting retention rates by 30%.

3. Threat of Substitutes

Big Tech firms (like Google Pay, Apple Pay) and emerging technologies like Decentralized Finance (DeFi) pose a significant threat.

How CIAM Counteracts Substitutes:

- Advanced Fraud Protection: Tools like multi-factor authentication (MFA) and API security prevent breaches and data theft.

- User Experience Excellence: Cloud-based CIAM systems match the seamlessness offered by Big Tech platforms.

Case Study NuData’s CIAM tools of fraud attempts while maintaining a frictionless user experience. NuData harnesses the power of behavioral and biometric analysis, enabling its clients to predict fraud with 99 % accuracy. [Source:Cbinsights]

4. Bargaining Power of Suppliers

BFSI institutions rely heavily on technology vendors to drive digital transformation. How CIAM Facilitates Vendor Collaboration:

- Interoperability: API-first CIAM solutions integrate seamlessly with existing tech stacks.

- Adaptability: Regular updates ensure institutions comply with emerging regulations and security requirements.

As regulatory demands grow, BFSI organizations will increasingly depend on CIAM providers like ForgeRock, Ping Identity, etc. for agility and compliance.

5. Industry Rivalry

Competition within BFSI industry is fierce, with institutions vying for differentiation through enhanced customer experiences and trust.

How CIAM Offers a Competitive Edge:

- CX Differentiation: Faster onboarding and personalized dashboards create superior user experience.

- Fraud Mitigation: Sophisticated fraud detection reduces financial losses and enhances trust.

Example: Sift’s CIAM solutions reduced weekly fraud losses by account takeovers (ATO) by $1.9 million for a capital markets firm [Source: GlobeNewswire]

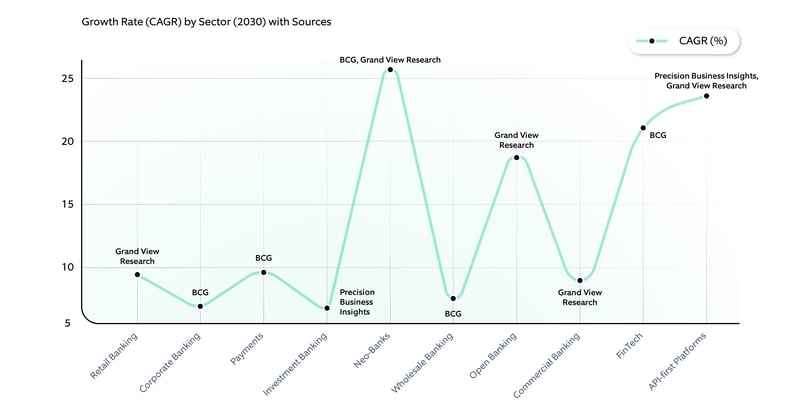

Anticipated market growth trends by 2030

Value Proposition in all BFSI sectors of different CIAM services

|

CIAM Services |

Banking |

Insurance |

Investment Firms |

FinTech |

NBFCs |

Payment Gateways |

Recommended CIAM Solution |

|

User Registration & Onboarding |

Seamless KYC Integration, Digital Identity Verification |

Policy-holder Identity Verification |

Investor Identity Verification |

Easy User Onboarding |

e-KYC & Simplified Forms |

Quick Onboarding |

Modular CIAM platforms with API-first approach for scalability and customization |

|

Adaptive Authentication |

Risk-based Authentication, Biometrics |

Context-aware MFA |

Device Fingerprinting |

AI-based Adaptive Techniques |

Geo-location Monitoring |

Step-up Authentication |

Behavioral Biometrics & AI/ML-driven systems |

|

Fraud Detection & Prevention |

Transaction Monitoring |

Anomaly Detection |

Anti-Money Laundering |

Fraud Risk Analysis |

Behavioral Analytics |

Real-time Fraud Alerts |

Fraud Management Platforms with API-first design |

|

Progressive Profiling |

- Collect transaction preferences gradually - Simplify KYC over multiple interactions |

- Capture policyholder details over time - Focus on life stages and health updates |

- Gradually collect risk tolerance and investment goals |

- Enable basic onboarding first - Add advanced data fields as customer use increases |

- Gather credit and financial profiles in steps - Simplify loan applications |

- Allow staged merchant and payment details - Gather transactional data progressively |

CIAM with advanced personalization and progressive profiling |

|

Personalization |

- Provide tailored savings or loan recommendations - Dynamic financial insights dashboards |

- Suggest policies based on user profiles and history - Tailor renewal reminders |

- Recommend portfolios aligned with goals - Customized alerts for market changes |

- Targeted financial literacy resources - Custom loan or investment options |

- Suggest tailored loan or EMI plans - Personalized borrower-lender matchmaking |

- Offer targeted promotions - Provide cashback or rewards based on purchase history |

AI-driven CIAM with personalization and recommendation engine |

|

Omni-channel Management |

- Seamless access across apps, branches, and web - Unified login for all services |

- Ensure policy updates are accessible across the web, apps, and agent-assisted platforms |

- Synchronize portfolio data across mobile, desktop, and branch services |

- Unified identity for services like P2P lending and micro-investing apps |

- Provide consistent EMI management and status tracking across mobile and call centers |

- Enable cross-device transaction tracking - Synchronize receipts and account activity |

Multi-platform CIAM with integrated omnichannel support |

|

Zero Trust |

- Implement adaptive MFA for secure banking - Risk-based authentication for high-value transactions |

- Use geolocation for claims access - Verify agents with role-based permissions |

- Secure trading platforms with continuous authentication - Use encryption for sensitive data |

- Prevent fraud with behavioral analytics - Apply Zero Trust principles to financial APIs |

- Protect borrower-lender data with dynamic access control - Ensure compliance with sensitive data |

- Secure API interactions for payment gateways - Use continuous authentication for risky activities |

Zero Trust CIAM with behavioral analytics and continuous authentication |

|

Access Management |

Role-based Access Control |

Policy-based Authorization |

Investor Segmentation |

Dynamic Access |

Granular Access Controls |

Open Banking Compliance |

Identity-centric API gateways for secure integrations |

|

Analytics & Insights |

User Behavior Analytics |

Claims Processing Analytics |

Portfolio Insights |

Predictive Analytics |

Loan Repayment Trends |

Payment Trends Insights |

Integrated CIAM with Analytics Engine |

|

Customer Support Automation |

Chatbots for Support |

Policy Query Automation |

Investment Helpdesk Bots |

Virtual Assistants |

Automated Loan Queries |

AI-driven Support |

AI-powered CIAM integrated with CRM tools |

|

API-first Integration |

Open Banking APIs |

Insurance Aggregator APIs |

Portfolio Management APIs |

FinTech Service APIs |

Credit Risk APIs |

Payment API Ecosystems |

Composable CIAM with Open Standards (OAuth, SAML) |

|

Regulatory Compliance & Data Privacy |

GDPR, PSD2, PCI DSS |

HIPAA, IRDAI Guidelines |

SEC, FINRA Compliance |

GDPR, Local Regulations |

RBI Norms |

PCI DSS |

Compliance-focused CIAM with API-first strategy |

Ever-evolving Regulatory Compliance across BFSI Sectors with Modern CIAM Solutions

Modern Customer Identity and Access Management (CIAM) solutions play a crucial role in enabling organizations to meet regulatory requirements simultaneously enhancing customer experience.

Here’s how they are relevant:

- Data Protection and Privacy: Considering regulations like GDPR and CCPA, BFSI firms must prioritize data protection. CIAM solutions facilitate secure customer identity management, ensuring that personal data is collected, stored, and processed in compliance with these regulations.

- Seamless Onboarding and Authentication: Modern CIAM solutions enable streamlined onboarding processes while upholding compliance standards. By implementing Single Sign-On (SSO) and multi-factor authentication (MFA), firms can enhance security and improve the user experience, minimizing friction during customer interactions.

- Risk Management and Fraud Prevention: CIAM solutions provide advanced analytics and robust monitoring capabilities, empowering BFSI organizations to detect and respond to fraudulent activities in real-time. This proactive approach contributes to compliance with anti-money laundering (AML) regulations and safeguards the organization’s brand loyalty.

- Adaptability to Regulatory Changes: The regulatory landscape is constantly evolving. Modern CIAM solutions are designed to be flexible and scalable, enabling BFSI firms to swiftly adapt to new regulations and compliance requirements without the need for a complete system overhaul.

- Customer Trust and Loyalty: By demonstrating a commitment to regulatory compliance and data security, BFSI organizations can build trust with their customers. This trust is essential for customer retention and brand loyalty in a competitive digital marketplace.

|

BFSI Sector |

Regulatory Compliance Requirements |

CIAM Solutions offering regulatory & compliance in market |

Key Services Offered |

|

Banking |

KYC, AML, GDPR, PSD2 |

ForgeRock, Okta, Ping Identity, etc. |

Identity verification, access management, compliance monitoring |

|

Insurance |

Data Protection, CCPA, HIPAA |

Microsoft Entra, One Identity etc. |

Secure onboarding, consent management, fraud prevention |

|

Capital Markets |

MiFID II, SEC Regulations, AML, FATCA |

Auth0, SailPoint etc. |

Role-based access, audit trails, data access control |

|

Payments |

PCI-DSS, PSD2, Tokenization |

IBM Security Verify, CyberArk etc. |

Transaction authentication, risk analytics, secure tokenization |

|

Fintech |

SOC 2, ISO 27001, Open Banking |

Okta, ForgeRock etc. |

API security, developer-friendly CIAM integration |

Biometric Authentication Across BFSI Sectors

Biometric authentication uses unique biological characteristic of an individual, such as fingerprints, facial recognition, iris scans, or voice recognition, to verify identity.

Users provide their biometric data, which is then compared to stored templates to authenticate their identity. This method is often seen as highly secure due to the uniqueness of biometric traits.

It is commonly used for secure access to mobile banking apps, ATMs, and high-security transactions in the BFSI sector.

|

BFSI Sector |

CIAM Solutions |

BFSI common instances |

|

Banking |

ForgeRock, Ping Identity |

Facial recognition for secure banking, fingerprint login |

|

Insurance |

Microsoft Entra, Okta |

Voice recognition for claims processing |

|

Capital Markets |

IBM Security Verify, SailPoint |

Retinal scans for high-value transactions |

|

Payments |

Auth0, CyberArk |

Palm vein biometrics for transaction security |

|

Fintech |

One Identity, ForgeRock |

Multi-modal biometrics for app security |

Adaptive Authentication Across BFSI Sectors

Adaptive authentication is a dynamic security approach that assesses the risk level of a login attempt based on various contextual factors, such as user behavior, device, location, and time.

The system evaluates the risk associated with each login attempt and adjusts the authentication requirements accordingly. For example, if a user logs in from a new device or location, additional verification steps may be required.

It is useful for protecting accounts from unauthorized access while minimizing friction for legitimate users, especially in online banking and financial transactions.

|

BFSI Sector |

CIAM Solutions |

BFSI common instances |

|

Banking |

ForgeRock, Microsoft Entra |

Risk-based authentication for login attempts |

|

Insurance |

Okta, CyberArk |

Device-based risk evaluation for secure claims access |

|

Capital Markets |

SailPoint, IBM Security Verify |

Adaptive MFA for critical system access |

|

Payments |

Auth0, Ping Identity |

Behavioral analytics for fraud detection |

|

Fintech |

ForgeRock, One Identity |

Real-time anomaly detection for payment systems |

Fraud Detection Techniques within BFSI

Fraud detection can be achieved through real-time analysis of user behavior, transaction patterns, and other contextual signals in BFSI industry. It prevents identity theft, account takeovers, or unauthorized transactions. Common generic use case for all industries would be "a login from an unusual location or device triggers additional verification steps."

The table below shows fraud detection techniques that can be used across diverse BFI sectors.

|

Technique |

Description |

BFSI common instances |

Solution in market |

|

User Behavior Analytics (UBA) |

Detects anomalies in login patterns, session durations, and device usage. |

Flags unusual login behaviors in retail banking or insider risks in corporate banking. |

ForgeRock AI-driven Analytics etc. |

|

Risk-Based Authentication (RBA) |

Dynamically adjusts security requirements based on real-time risk levels. |

Blocks risky trades in investment banking or suspicious account access in wholesale banking. |

Ping Identity Risk Intelligence etc. |

|

Machine Learning Models |

Identifies fraud patterns like identity theft or phishing using AI. |

Prevents fraudulent loan applications or insider threats in trading platforms. |

ForgeRock, Microsoft Azure AI etc. |

|

Geo-Fencing & Device Fingerprinting |

Tracks location and unique device identifiers to prevent unauthorized access. |

Blocks location-spoofed access attempts in neo-banks or unauthorized device usage in insurance claims portals. |

Ping Identity, Okta etc. |

Zero Trust CIAM for BFSI Sectors

The zero-trust model is a security framework that assumes no user or system is inherently trustworthy, even if they are inside the network perimeter. Every access request is verified based on context and continuously monitored, especially for high value secured transaction.

It can be used across diverse BFI sectors as shown in the table below.

|

BFSI Sector |

Zero Trust Features |

Description |

Solutions in market |

|

Banking |

Dynamic Risk Assessment |

Continuous monitoring and verification of user identities. |

CyberArk, ForgeRock |

|

Insurance |

Least-Privilege Access |

Access granted only to required data or resources. |

SailPoint, Microsoft Entra |

|

Capital Markets |

Continuous Verification |

Verifies users throughout the session, not just login. |

Ping Identity, Auth0 |

|

Payments |

Real-Time Anomaly Detection |

Flags suspicious activities in payment systems. |

ForgeRock, CyberArk |

|

Fintech |

Policy Enforcement Automation |

Apply dynamic policies based on risk evaluation. |

Okta, ForgeRock |

These are different services but interconnected within CIAM, with fraud detection and zero trust enhancing security, while biometric and adaptive authentication ensure seamless and secure user verification. All contribute to the authentication and access control domain but address unique user security and experience aspects. With different BFSI segments, it holds a strong shield for BFSI customer protection against ATO (account takeover) or anti-money laundering (AML) phishing attacks, etc.

Navigating the path to successful adoption of modern CIAM Solutions in the BFSI domain

The journey towards adopting modern CIAM solutions within the BFSI sector presents a unique set of opportunities and considerations. While some challenges are inevitable, a proactive approach can ensure a smooth and successful transition.

1. Embrace Change

Employees accustomed to traditional processes may hesitate to embrace new technologies, fearing disruption to their existing workflows. This resistance can slow down the implementation process and hinder the overall effectiveness of the CIAM solution. While change can initially disrupt existing workflows, it also presents an opportunity to streamline processes and improve efficiency. Organizations can effectively address employee concerns and ensure a smooth transition by fostering a culture of continuous improvement and open communication.

2. Leverage Legacy Systems Integration as an opportunity

Many BFSI institutions operate on legacy systems, leading to integration challenges with modern CIAM solutions. This can lead to compatibility issues, data silos, and increased operational complexity. However, integrating CIAM with existing systems can be an opportunity to modernize the overall technology stack. This can improve data flow, enhance security, and create a more unified customer view. Organizations must carefully plan and invest resources to ensure a smooth integration that overcomes these challenges and unlocks significant benefits.

3. Prioritize Data Privacy and Compliance Concerns

The BFSI landscape is heavily regulated, with organizations navigating the complexities of data privacy laws and stringent compliance requirements. Implementing modern CIAM solutions necessitates a deep understanding of these regulations to ensure secure data handling and strict compliance with legal standards. Failure to comply can result in substantial penalties and damage to the organization’s reputation. However, organizations must view data privacy and compliance as an opportunity to build customer trust. By implementing robust CIAM solutions that adhere to the highest security and compliance standards, organizations can demonstrate their commitment to customer data protection, enhance brand reputation, and foster lasting customer relationships.

4. Focus on User-centricity

While modern CIAM solutions aim to enhance the user experience, the transition can sometimes confuse customers. If not implemented thoughtfully, new authentication processes or identity verification methods may frustrate users, leading to increased abandonment rates and dissatisfaction. Organizations must prioritize user-centric design to ensure a smooth transition. By actively involving users in the design and testing phases, organizations can ensure that new CIAM solutions are intuitive, easy to use, and ultimately enhance the customer journey.

5. Invest in Training and Minimizing Skill Gaps

Many BFSI institutions may face skill gaps within their existing workforce, as they may lack the necessary expertise to manage and operate new CIAM systems. Investing in training and development is crucial to equip employees with the skills needed to leverage this modern solution effectively. This enhances employee capabilities and fosters a culture of innovation and continuous learning within the organization.

6. Balance cost with long-lasting value

Adopting modern CIAM solutions can involve significant upfront costs, including software licensing, infrastructure upgrades, and training expenses. BFSI institutions must carefully evaluate their budgets and consider the long-term return on investment (ROI) to justify the transition. While upfront costs can be significant, viewing CIAM implementation as a long-term investment is essential. Organizations can justify the necessary investments by carefully evaluating the ROI and focusing on the long-term benefits, such as improved customer satisfaction, increased efficiency, and early fraud detection.

By embracing these considerations and approaching the transition with a proactive and strategic mindset, BFSI institutions can successfully navigate the challenges of CIAM implementation and unlock a new era of enhanced security, improved customer experience, and ultimately drive business success. By fostering a culture of change, investing in training, and prioritizing user experience, organizations can successfully navigate the complexities of CIAM implementation.

How CIAM services enhance Customer Relationships?

Here’s how CIAM solutions contribute to strengthening relationships within the BFSI sector:

1. Personalized Customer Experiences

CIAM solutions enable BFSI institutions to gather and analyze customer data effectively. By understanding customer preferences and behaviors, organizations can tailor their services and communications to meet individual needs. This personalization fosters a deeper connection with customers, enhancing their overall experience and satisfaction.

2. Streamlined Onboarding Processes

A smooth onboarding process is essential for establishing a positive relationship with new customers. CIAM solutions simplify identity verification and authentication, allowing customers to access services quickly and efficiently. By reducing friction during onboarding, BFSI institutions can create a favorable first impression and build trust from the outset.

3. Enhanced Security and Trust

Security is a top concern for customers in the BFSI sector. CIAM solutions provide robust security features, such as multi-factor authentication and advanced encryption, ensuring that customer data is protected. By prioritizing security, organizations can instill confidence in their customers, reinforcing trust and loyalty.

4. Omnichannel Engagement

Modern customers expect a seamless experience across multiple online, mobile, or in-person channels. CIAM solutions facilitate omnichannel engagement by allowing customers to access their accounts and services consistently across different platforms. This continuity enhances customer relationships by providing convenience and flexibility.

5. Efficient Customer Support

CIAM solutions enable BFSI institutions to maintain comprehensive customer profiles, allowing support teams to access relevant information quickly. This efficiency leads to faster resolution of customer inquiries and issues, improving overall satisfaction. When customers feel valued and supported, their loyalty to the institution strengthens.

6. Data-Driven Insights for Relationship Management

CIAM solutions provide valuable analytics and insights into customer behavior and preferences. BFSI institutions can leverage this data to identify trends, anticipate customer needs, and proactively engage with clients. Organizations can foster long-term relationships and enhance customer retention by being responsive to customer needs.

7. Regulatory Compliance and Peace of Mind

In the BFSI sector, compliance with data protection regulations is critical. CIAM solutions help organizations manage customer consent and data privacy effectively, ensuring compliance with regulations such as GDPR and CCPA. Institutions can build trust and strengthen relationships with their customers by demonstrating a commitment to data protection.

CIAM solutions enhance relationships among BFSI sectors by providing personalized experiences, ensuring security, and facilitating efficient customer engagement.

How can Nagarro contribute to clients in implementing CIAM Solutions?

As organizations increasingly prioritize Customer Identity and Access Management (CIAM) solutions, choosing the right partner is critical for a smooth and effective implementation. With extensive experience in digital transformation and technology solutions, Nagarro brings deep expertise to organizations implementing CIAM.

Here's how Nagarro can support your efforts:

1. Comprehensive Needs Assessment – Consulting

We thoroughly assess a client’s current identity management processes and requirements. By understanding the unique challenges and goals of the organization, Nagarro can tailor CIAM solutions that align with the client’s specific needs and ensure a more effective implementation.

2. Custom Solution Design

With a deep understanding of various CIAM technologies and frameworks, Nagarro can design custom solutions that integrate seamlessly with existing systems. This includes selecting the right tools and technologies that best fit the client’s infrastructure, ensuring a smooth transition to modern CIAM practices.

3. Integration expertise

Nagarro’s CIAM experience in integrating complex systems facilitates smooth integration with legacy systems and other applications. This ensures organizations can leverage their existing investments while adopting modern identity management practices.

4. User-Centric Approach

Nagarro emphasizes a user-centric approach in CIAM implementations. By focusing on the end-user experience, we can help design intuitive interfaces and streamlined processes that enhance customer satisfaction and engagement, ultimately leading to stronger relationships.

5. Security and Compliance Assurance

With a strong focus on security, Nagarro implements CIAM solutions that uphold robust security measures like multi-factor authentication, encryption, and access controls. Additionally, Nagarro can ensure that the solutions comply with relevant regulations and standards, helping clients navigate the complexities of data protection and privacy.

6. Agile Implementation Methodology

Nagarro employs agile methodologies to ensure a flexible and iterative approach to CIAM implementation. This allows for continuous feedback and adjustments throughout the process, ensuring that the final solution meets the organization's evolving needs.

7. Training and Support

To ensure the successful adoption of CIAM solutions, Nagarro provides comprehensive training and support for client teams. This empowers organizations to manage and operate the new systems effectively, fostering a culture of security and awareness around identity management.

8. Ongoing Optimization and Maintenance

Nagarro can offer ongoing support and optimization services for post-implementation. By continuously monitoring the performance of CIAM solutions and making necessary adjustments, we help clients maximize the value of their investment and adapt to changing business needs.

By partnering with Nagarro, BFSI institutions can confidently navigate the complexities of the digital age, build a strong foundation for the future, deliver exceptional value to their customers and ultimately drive business success.

Conclusion

The BFSI sector faces unprecedented challenges and opportunities in today's hyper-connected world. Customers demand seamless, secure, personalized experiences while regulatory landscapes constantly evolve. Embracing Modern CIAM Solutions CIAM, (Customer Identity and Access Management) addresses inefficiencies in legacy systems, streamlines onboarding, and fortifies security for BFSI institutions. However, choosing the right partner is critical for a smooth and effective implementation. With extensive experience in digital transformation and technology solutions, Nagarro brings deep expertise to organizations implementing CIAM. By partnering with Nagarro, organizations can:

- Enhance customer experience: Deliver personalized experiences, streamline onboarding, and improve customer satisfaction.

- Bolster security: Strengthen fraud prevention, protect sensitive data, and ensure regulatory compliance.

- Drive operational efficiency: Streamline processes, reduce costs, and improve time-to-market for new products and services.

- Gain a competitive advantage: Leveraging Porter’s Five Forces, CIAM enhances customer retention, counters substitutes, and mitigates competition, solidifying market position.

Get in touch to learn more about how our CIAM expertise can help your organization achieve its business goals. Let us help you unlock the full potential of CIAM and drive success in the evolving financial services sector.