Marketing Dive projects the advertising revenue for media owners to hit $833 billion in 2023, up 5% from 2022’s $795 billion. Even though the sales are low, it hasn’t dampened the growth. According to a PwC , US digital newspaper advertising revenue is expected to surpass print media by 2026.

Advertising business today

In the media and publishing industry, content providers are the owners, suppliers, and sellers of the digital ad space. The publishers, may it be news, magazines, books, journals, etc., are not limited to print media. They have expanded their horizons to display, video, web, DooH, and audio. Television ads have evolved from showing fixed ads at a defined time (in the form of linear TV ads) to showing different ads to different viewers watching the same content simultaneously (Addressable TV ads).

Another type of advertisements being vastly used are interactive ads. These can be interactive banners or videos, or voice ads. The creative posts get users to respond to polls, quizzes, etc. The interactive video ads show certain product details and lead the viewers to the product page.

- Augmented reality ads: These ads give people an opportunity to try on apparel or view any product by placing it in an appropriate space in their house. Customers can interact with the products, thus helping in selecting.

- Playable in-app ads: In these advertisements, products are explored and understood through actions or navigation in the app, and a purchase option is provided at the end.

- In-game advertising: These advertisements are becoming popular with the increasing love for e-sports. Different ways to use interactive game ads are creating sponsored features, promoting billboards, and organizing events.

Changing user behavior leading to personalization

With technological advancements and new forms of advertising, the way advertisements are shown has also changed. The number and types of mobile devices have increased, and the viewers have more purchasing power and are spoilt for choices. With the increase in competition, targeted advertisements catering to personalized viewer needs are in demand. Publishers only care a little about who sees the ad—however, the demand side hunts for ad space that has the viewers they are targeting.

Open marketplace vs. closed marketplace

For ad monetization, publishers can list their inventory in an open or closed marketplace. Advertisers and publishers in an open marketplace can buy and sell ad inventory in a transparent, open to all space with no restrictions. These ads we usually see on YouTube, games, or any news websites. In a closed marketplace, access is restricted to specific groups of buyers and sellers. Typically, these advertisements are seen on business-specific websites like travel, real-estate, or e-commerce. Though opportunities may be fewer and advertising costs higher in a closed marketplace, advertising is more effective and expected to reach a highly targeted audience.

Advertising in a closed marketplace

Closed marketplace advertising either includes private marketplace or preferred deals, or programmatic guaranteed deals:

- Private marketplace: Publishers maintain and manage their inventory and control the pricing by dealing directly with the advertisers. Advertisers get access to premium inventory and can target specific audiences.

- Preferred deals: Some advertisers get a preference over others and can bid on a negotiated price.

- Programmatic guaranteed deals: In these automated deals, particular inventory is available to specific advertisers only, but they secure the inventory in advance with guaranteed impressions and pricing.

Google Ad Manager, AdRoll, are readily available ad networks that publishers can use to manage the ad selling. This allows publishers to leverage the ad network’s domain specialization and display advertisements more suited to the visitors. The audience data, mostly collected via cookies, is owned by a third party (in this case, the ad network). The ad network manages an end-to-end campaign. Publishers pay a share (sometimes a major share) of their revenue to the ad network provider.

The challenge: Multiple ad platforms managing different media inventories in silos.

Publishers with varied media inventories (like video, web, audio, DooH, and display) need different ad platforms to manage ad displays, as each ad platform is suitable for one specific ad inventory type. This can lead to multiple ad platforms managing different media inventories in silos. Publishers are at a risk at losing the additional monetization opportunity that comes with product bundling, cross-selling, etc.

Well-established players with many ad inventories and advertisers are on the direct sell. Some are even investing in programmatic selling. Many publishers manage it manually through forms, while others have their own self-service platforms that let advertisers buy premium inventory on publisher’s site in real-time. In 2021, The Washington Post debuted by launching their own ad network Zeus Prime. Implementing their own application to manage the ad selling brings the dual advantage of sole ownership of the revenue and controlling the audience data.

The solution: A SaaS-based, custom-built, or hybrid platform.

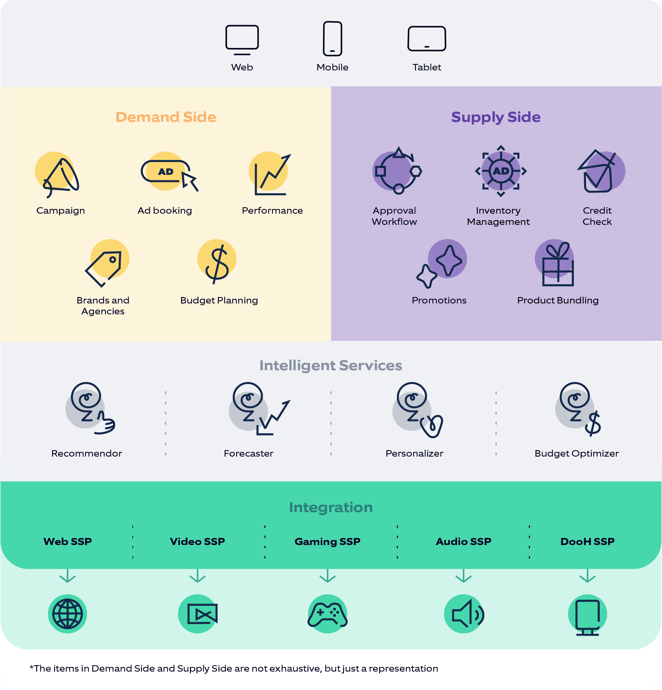

The preferred solution is to use a SaaS-based channel-specific supply-side platform to manage the ad display and inventory-specific campaigns. Also, create a custom ad sales platform that allows product bundling, cross-selling, low yield inventory promotion, and above all, target specific audiences across all channels.

Bringing in the right partner for custom platform development to manage ad sales would have additional resources and system requirements accounting for the initial cost. But, on execution, 100% of the revenue goes into the publisher’s books. The user data stays with the publisher and can be analyzed to provide targeted segmented advertisements. If having multiple publications or advertising packages, a publisher can provide the same advertisement to a user interested in a particular content but viewing the ad in different formats or devices. Since third-party cookies are almost out of the way now, audience data becomes even more relevant. Publishers can and should take control of their audience data.

Advertisers will be looking to partner with publishers who have more control over their first-party data. The Customer Data Platform (CDP) would support personalization by providing audience insights beyond the obvious. This creates an opportunity to make the remnant inventory valuable. The advertisement consumption data can, in turn, be used to generate content/product recommendations. Publishers can also partner with brands to create sponsored content and have additional monetization opportunities.

A hybrid ad management platform with SaaS-based SSP and a custom ad sales platform provides a better architecture to manage the entire ecosystem, bringing agility and flexibility to scale with the business strategy and roadmap. The workflow can be trimmed or enhanced as per the changing needs. The initial cost of having such a platform might be high, but easy product bundling and other monetization strategies enabled by this platform will increase the revenue manifold.

Endnote

Businesses must gauge the scale of their ad inventory, audience, and advertisers, evaluate their digital maturity, and decide whether to use a SaaS-based ad management platform, custom-built one, or a hybrid ecosystem. Having this decision in alignment with their business strategy will ensure that businesses achieve the level of digital maturity they envision.