What is risk-adjusted performance management? How is it replacing the traditional profitability metrics in banks and financial institutions? Read this article to gain insights on the topic, take high risks, and earn high returns.

With expanded business opportunities, intensifying competition, non-performing loans (NPL) challenges, and demand for high returns on stakeholders’ investments, risk-adjusted performance measures assume greater importance in the banking and financial services world.

Banks prefer to track metrics that can provide forward-looking capabilities to gain insights into their current as well as future investment opportunities.

However, the traditional metrics don’t consider the risks involved across different investments made by banks and miss the true value of return that the banks earn. In this context, let’s explore how risk-adjusted performance measures are helping in:

- Making informed decisions on pricing and investment opportunities

- Diversifying capital across product lines and portfolios based on risks

- Complying with Basel regulations.

Challenges faced by banks

Banks & financial institutions use Return on Assets (ROA) and Return on Equity (ROE) as key metrics to evaluate their performance for a long time. Let’s quickly understand what these metrics are:

Return on Assets (ROA) – It’s a helpful metric in gauging the profit a bank is generating over the years against its capital investment in assets. When a bank’s ROA rises over time, it indicates that it is gaining more profits from its assets. Conversely, a declining ROA suggests a bank has made bad investments/ credits, is spending too much money, and may be headed for trouble.

Return on Equity (ROE) – It measures how effectively a bank is generating profit from the money that investors have put in the form of equity. A higher ROE indicates that a bank is effectively using the contributions of equity investors to generate additional profits and return the profits to them at an attractive level, and vice versa.

With the increase in global investment opportunities and related risks of Non-Performing Assets (NPA), these metrics miss significance/insights in providing true value to stakeholders. Some of the reasons are:

- They lack forward-looking capabilities to diversify the bank’s capital across different product lines/units based on current and future market trends.

- They don’t consider risks associated with different investments and lack the true value of returns generated from them.

- The Basel framework's Internal Capital Adequacy Assessment Process (ICAAP) requires banks to hold additional capital for coverage for losses based on their risk profile. This has limited the amount of capital the bank can invest & earn profits, resulting in lower ROE.

How, then, are risk-adjusted performance measures helping banks in overcoming these challenges? Let’s explore the topic now.

RAROC, RORAC, and RARORAC metrics

First, let’s summarize some fundamentals on which these metrics are based: Basel regulations, economic capital, and hurdle rate.

Basel regulations

The Basel Committee on banking supervision issued a proposal with three mutually reinforcing pillars, allowing banks and supervisors to evaluate properly the various risks that banks face. These three pillars are:- Minimum capital requirements, which seek to refine the measurements framework set out in the 1988 Capital Accord (dealing with credit risk, operational risk, and market risk)

- Supervisory review of an institution’s capital adequacy and internal assessment process

- Market discipline through effective disclosure to encourage safe and sound banking practices.

Economic capital

According to the economic perspective of ICAAP (Internal Capital Adequacy Assessment Process), the bank is expected to ensure that its risks are adequately covered by internal capital in line with its internal capital adequacy concept. This concept includes both Economic and Regulatory Capital.

- Economic capital is an institution’s own capital estimate of the amount it needs to remain solvent and maintain its day-to-day operations.

- Regulatory capital is the minimum amount of capital an institution is required to hold in accordance with the advice from the bank regulators.

This economic capital is used to evaluate the risk-adjusted performance of banks across different investments, units, and portfolios.

Hurdle rate

Banks compare their results against hurdle rate – the minimum required rate of return or target rate they expect to receive on an investment.

Banks use this as a benchmark to make investment decisions. If the results of the evaluation metrics are greater than the hurdle rate, the investment may be pursued because it is deemed to add value to the bank.

Let’s now check some evaluation metrics:

RAROC (Risk-adjusted return on capital)

Determines the return on investment by adjusting all the associated risks. It expresses risk-adjusted returns as a percentage of economic capital.Formula:

RAROC = {Expected revenue – (Operating cost + Interest charges) + Return on capital – Expected losses}/Economic capital.

- Expected revenue: Revenue expected to be generated by the investment

- Operating cost: Expenses associated with running the bank’s business (salaries, rent, infrastructure expenses, etc.)

- Interest charges: Interest that the bank gives on the deposits

- Return on capital: Return that the bank earns on their risk-free investments (like, in government bonds) using economic capital reserves

- Expected losses: Expected loss amount from loan default

- Economic capital: Capital reserve that the bank must make to protect it against unexpected losses

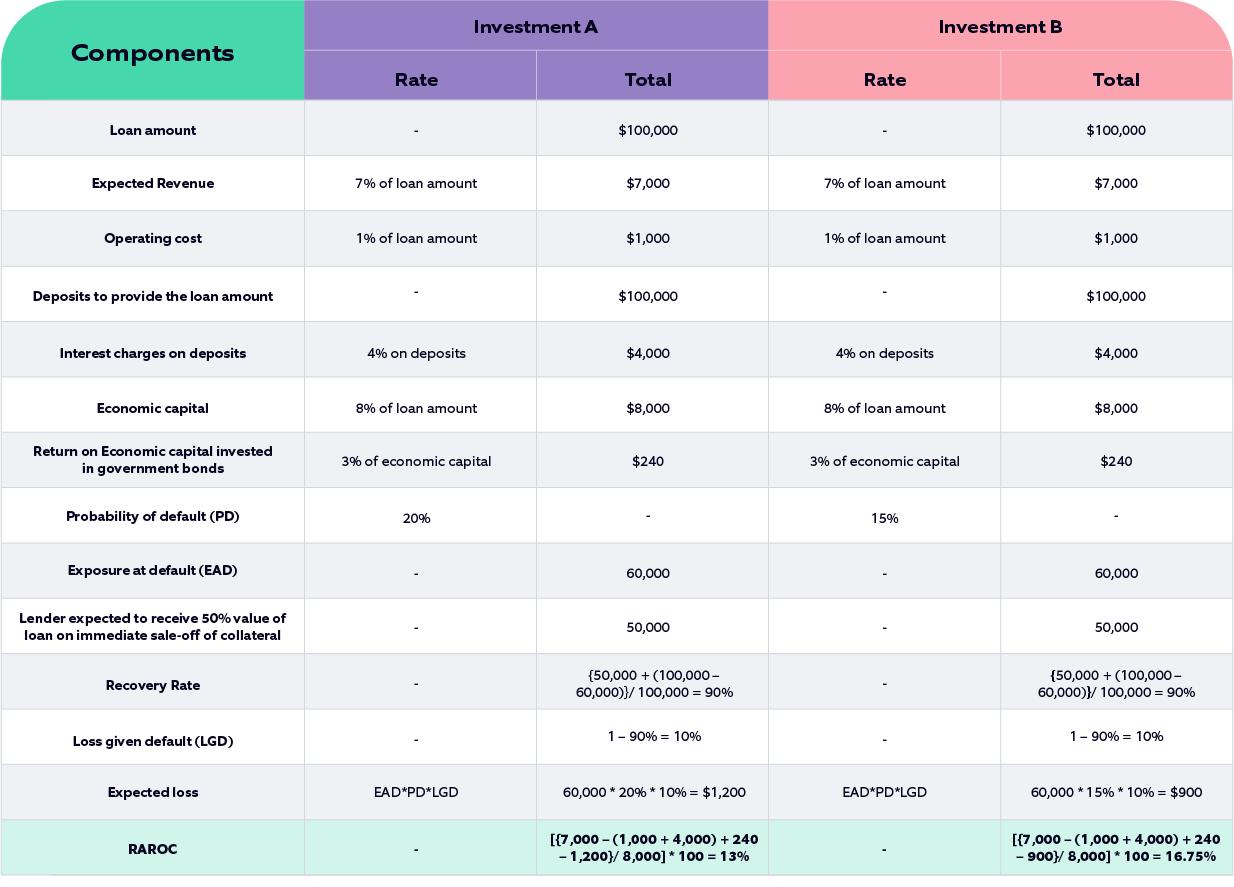

Example: Consider ABC Bank planning the following investments:

Considering the hurdle rate for ABC bank = 10% (for example), the bank can pursue both investments as both have RAROC > hurdle rate. However, if the bank needs to pursue only one, then Investment B would be preferred as it has RAROC (16.75%), which is greater than the RAROC of Investment A (13%).

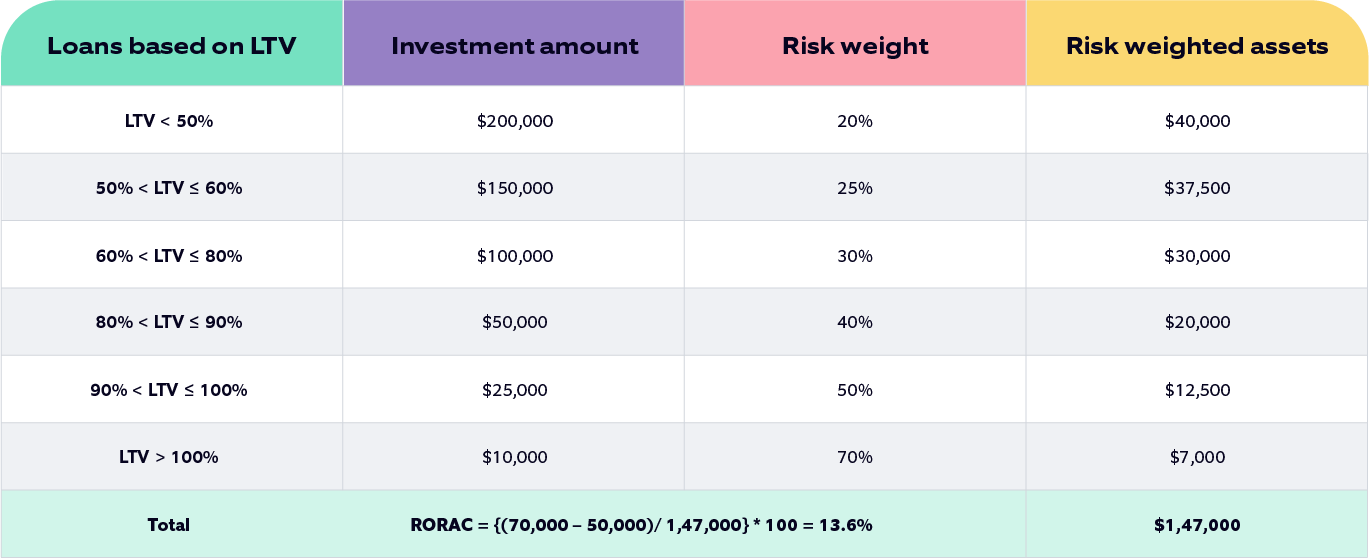

RORAC (Return on Risk Adjusted Capital)

- Determines the rate of return that the bank earns on the risk-adjusted capital investments in its different products & offerings.

- It’s the net income calculated as a percentage of the risk-weighted assets.

- The risk weights are the percentage factors that adjust the credit risks of different loan types and other assets of a bank to reflect the level of risk/loss to the bank. Basel committee ‘Standardized approach’ prescribed the risk weightage assigned to different assets. Generally, secured assets (like mortgage loans secured by residential properties) have low-risk weights than unsecured assets (like credit cards).

Formula:

RORAC = Net Income/Risk-weighted assets

(where Net Income = Total revenue – Total expenses)

Example: Consider the overall portfolio of mortgage loans for ABC Bank:

Total Revenue = $70,000

Total Expenses = $50,000

RORAC results can be compared against the hurdle rate and the portfolio's profitability target. Accordingly, the capital can be diversified.

RARORAC (Risk Adjusted Return on Risk Adjusted Capital)

- It combines both RAROC and RORAC for accounting risk on bank returns and the allocated economic capital.

- As per the construction, the RARORAC increases with the increase in value creation and decreases when the assumed risk increases.

Formula:

RARORAC = Risk-adjusted return/ Risk-weighted assets

Example: Consider ABC Bank is planning the below investment.

.png?width=770&height=931&name=MicrosoftTeams-image%20(94).png)

The RARORAC result is characterized as “economic profit” since it is the revenue earned above and beyond the risk compensation. If the RARORAC result/economic profit is positive, the investment adds value to stakeholders more than the cost of capital.

What and when to choose RAROC, RORAC, and RARORAC

Note: Banks may choose the most appropriate metric based on their specific decision-making context and requirements.

Note: Banks may choose the most appropriate metric based on their specific decision-making context and requirements.

Home loan use case – Near real-time insights on RAROC/RORAC/RARORAC

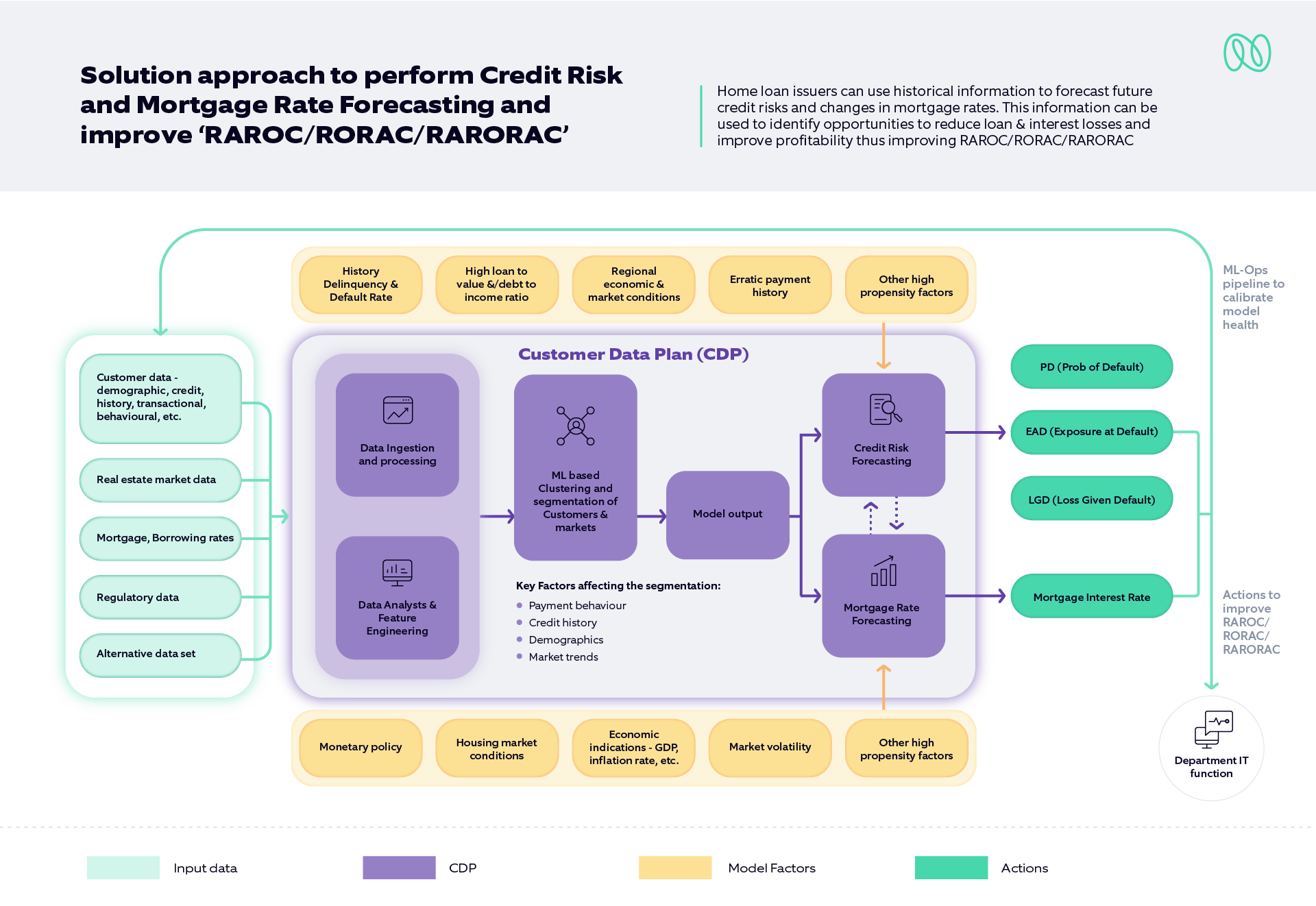

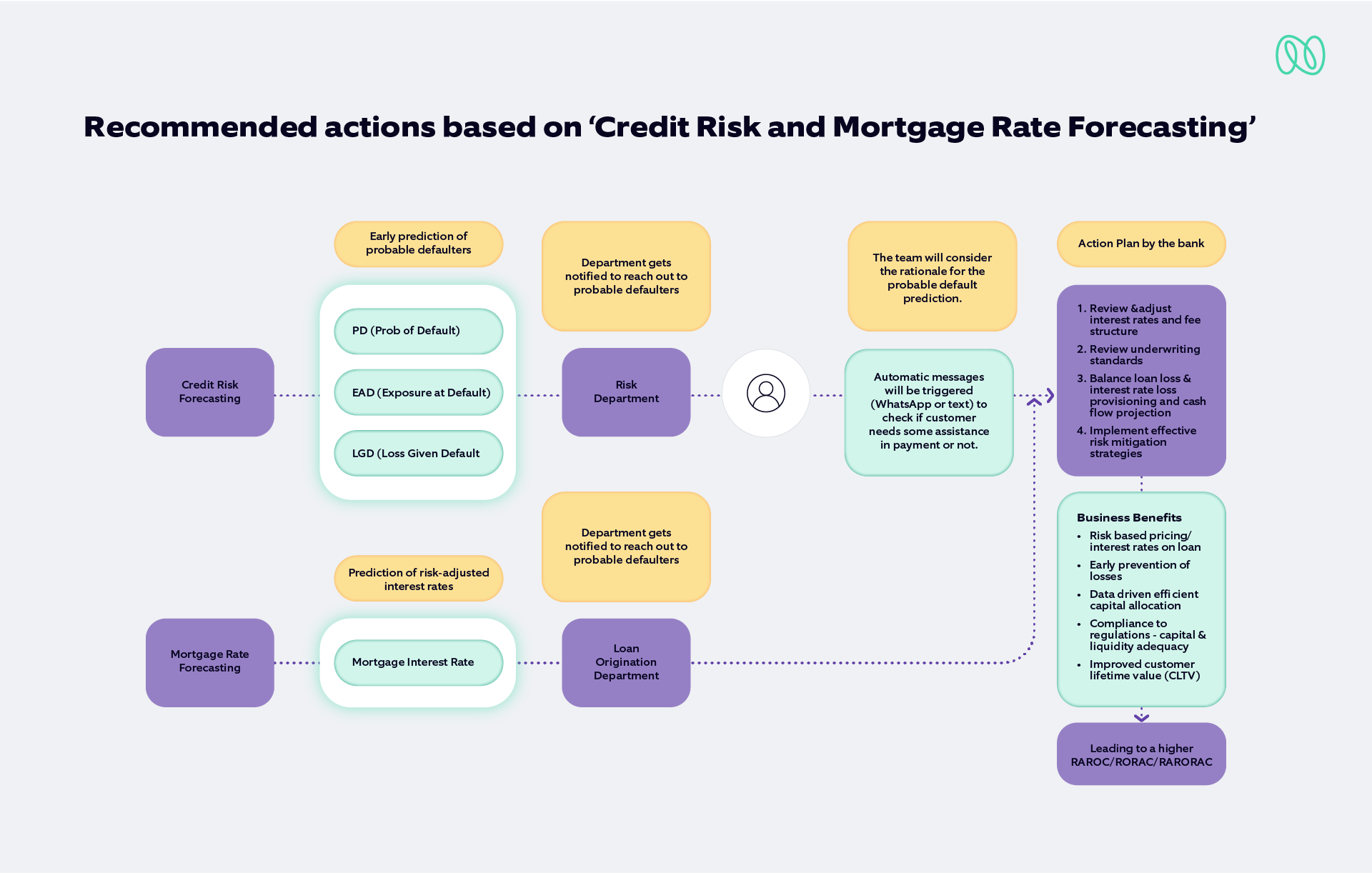

Nagarro leverages technologies like data engineering, data analytics, and Machine Learning (ML) to assess risk-performance metrics in near real-time, helping banks make proactive data-driven decisions.

At Nagarro, we ensure the CDP (customer data platform) is robust enough to process the data captured near real-time for analytics. Next, we use business criteria to divide customers and markets into buckets and feed the output into an ML model – that utilizes historical data to predict customers likely to default and mortgage rate changes.

This model helps banks calculate risk-performance metrics, helping banks better assess credit and interest rate loss risks, make informed decisions about lending policies, interest rates, and loss provisioning, and proactively manage potential risks. In other words, the approach enables banks to improve their customer lifetime value (CLTV) and overall performance targets.

Figure 1: Solution approach to perform credit risk & mortgage rate forecasting and improve RAROC/RORAC/RARORAC.

Figure 2: Recommended actions & benefits based upon ‘credit risk & mortgage rate forecasting.’

Endnote

All three metrics can be useful in evaluating the risks associated with the return & capital of investments. However, RARORAC is the most comprehensive measure to evaluate economic value added by different investments and comply with the Basel regulations.

In addition to profitability targets, these ratios help banks in defining compensation plans, like pay-for-performance, that link compensation to shareholder’s value-added.

Technology advancements and data analytics have made it easier for banks to collect and analyze data on their investments. This has further increased the use and sophistication of risk-adjusted profitability measures.

Are you interested in making informed decisions to improve your customer lifetime value (CLTV) and overall performance targets/metrics? Let's talk!

-1.png)